Which U.S. counties are in danger of flooding?

With severe weather events on the rise, LawnStarter ranked 2025’s Most Vulnerable Counties for Flooding, using 11 metrics across 4 categories.

Some findings? Estimated annual losses from river flooding total $5.9 billion, almost 5x the $1.2 billion estimated for coastal floods.

- Nearly 4 in 10 counties (364 of 943) face a double whammy of both coastal and river flood risk.

- Collectively, just 5 counties soak up $1.4 billion in estimated annual river-flood losses, 3 of them in Texas.

- 17 New Jersey counties could account for a staggering 52% of all U.S. coastal flood losses annually, around $634 million per year.

See where over 940 counties with FEMA-designated flood risk ranked below. To learn how we ranked the counties, see our methodology.

Contents

- County Rankings

- Top 5 Most Vulnerable Counties for Flooding

- Key Insights

- Estimated Annual Loss from Flooding

- Ask the Experts

- Methodology

- Protecting Your Lawn From Flood Damage

County Rankings

See how each county fared in our ranking:

Top 5 Most Vulnerable Counties for Flooding

Check out the slideshow below for a closer look at each of our 5 counties with the highest flood risk.

Key Insights

More than half of the 100 most flood-prone counties are in Gulf Coast states like Texas, Louisiana, and Florida. Deadly river floods this July in Central Texas underscore the risk, sending rivers like the Guadalupe surging and taking lives in multiple counties, including Kerr (No. 282), Travis (No. 309), and Williamson (No. 694).

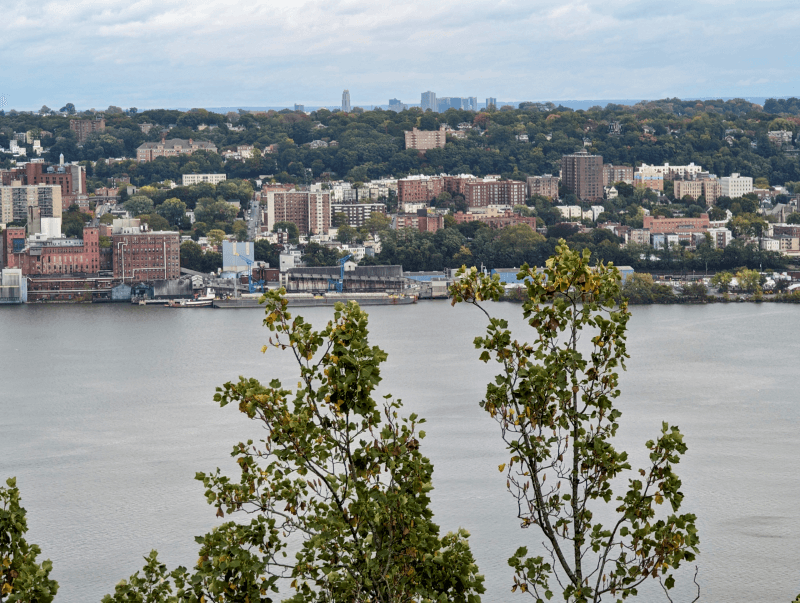

New Jersey counties dominate the flood risk ranking, claiming 4 of the top 5 spots. This surge in risk comes as deadly flash floods in July left two dead in Union County (No. 42), home to Plainfield, and forced a statewide emergency declaration.

- Bergen County (No. 1), Ocean County (No. 3), and Cape May County (No. 4) were among areas hit by torrential rains, while neighboring New York counties like Kings (No. 7) and Bronx (No. 10) faced subway shutdowns during one of the city’s rainiest hours on record.

All counties in our ranking have at least moderate flood risk, according to FEMA. Counties with some of the lowest overall flood risk include Charles County, Maryland (No. 943), Lake County, Florida (No. 942), and Colonial Heights, Virginia (No. 941). Many counties near the bottom have more moderate flood risk because of smaller populations and lower economic impact from flooding

River vs. Coastal Flood Risk

River flood risks remain highest in Gulf Coast counties such as Harris (No. 2), Galveston (No. 37), and Brazoria (No. 45) in Texas, which together face the highest expected economic losses nationally from riverine flooding, $1.2 billion collectively.

Inland counties experience high risk for river flooding, including La Paz County, Arizona (No. 6), and Jefferson County, Kentucky (No. 8).

- La Paz County, home to Parker, is vulnerable to flooding from the Colorado River and faces millions in potential damages, exacerbated by its high share of mobile homes (over 54%). Jefferson County, along the Ohio River, could incur more than $14 million in damages from river flooding.

Coastal flood risk crowds the Mid-Atlantic and Northeast, with 12 New Jersey, 8 Virginia, and 7 New York counties among FEMA’s 50 highest coastal risk scores. Beyond that hotspot, Clatsop County, Oregon (No. 36), and Grays Harbor, Washington (No. 764), hold the Pacific’s highest coastal risk spots, while Cameron County, Texas (No. 11), leads the Gulf Coast.

Dive deeper into regional flooding insights below.

Estimated Annual Loss from Flooding

The financial impact of flooding varies between riverine and coastal counties, with Gulf Coast riverine areas facing some of the highest expected annual losses, while coastal counties along the Mid-Atlantic and West Coast experience substantial risks from storm surges and rising seas.

Top Counties With the Highest Estimated River Flooding Financial Loss

1. Harris County, TX

Houston, Pasadena, Baytown

$676.2 million

2. Galveston County, TX

Galveston, League City, Texas City

$337.3 million

3. Brazoria County, TX

Pearland, Alvin, Lake Jackson

$160.1 million

4. East Baton Rouge Parish, LA

Baton Rouge, Central, Zachary

$147.9 million

5. Shelby County, TN

Memphis, Collierville, Germantown

$111.0 million

6. Lafayette Parish, LA

Lafayette, Youngsville, Broussard

$99.3 million

Top Counties With the Highest Estimated Coastal Flooding Financial Loss

1. Bergen County, NJ

Hackensack, Teaneck, Fort Lee

$210.4 million

2. Ocean County, NJ

Lakewood, Toms River, Brick

$100.5 million

3. Atlantic County, NJ

Atlantic City, Egg Harbor, Galloway

$77.5 million

4. Cape May County, NJ

Lower Township, Middle Township, Upper Township

$64.7 million

5. Monmouth County, NJ

Middletown, Howell, Marlboro

$60.6 million

6. Hudson County, NJ

Jersey City, Bayonne, Union City

$48.0 million

Ask the Experts

We turned to a panel of experts to learn more about flood events and gather practical tips on protecting your home from flood damage. Read their advice below on preparing for floods, assessing damage, flood insurance, common flood causes, and how flooding affects residential landscaping.

- What, if anything, can homeowners do ahead of a flood to mitigate damage?

- What are the steps for assessing damage after a flood?

- Who should purchase flood insurance?

- What are 3 of the most common causes of flooding in the U.S.?

- How can flooding impact residential landscaping?

What, if anything, can homeowners do ahead of a flood to mitigate damage?

First off, keep the water out of your house. This can be:

- Traditional flood barriers.

- DIY flood barriers if it is too late to source traditional flood barriers.

- Flood defense landscaping where you can create somewhat of a raised berm or planter box in areas around the house wherever you can.

I understand you don’t want to “live in a bowl” with a berm all the way around your house, but most yards have sections where they could create a berm or a raised planter bed that will create a part of a protective perimeter. By doing this, it lessens your requirement to purchase, store, and/or deploy traditional flood barriers.

We call it flood defense landscaping where you can then do a “gap closure” by installing flood barriers (for example, across your driveway where a berm is unacceptable). This is the first line of defense.

Additional lines of defense are great where you could simply wrap your house (or doors) with plastic sheeting. It is important that the plastic sheeting is taped (we use heated Gorilla tape) around the perimeter of a door or securely stuck to the soil surfaces such that water gets on top of the plastic first, which then forms a great seal to the ground and prevents seepage.

We call the sump pump the ‘last line of defense’. There are lots of water-activated systems if you have to evacuate but keep in mind that in many flood situations, the power will go out so it is good to have a backup power supply, if at all possible.

What are the steps for assessing damage after a flood?

I focus exclusively on stopping the floodwater. From my perspective, I would assess:

- Where the water comes from.

- What types of erosion took place.

- How long you had to react.

- Where water entered the structure to prevent it from happening again.

NOTE: During a flood, seepage is going to happen. Your objective is to keep the water at bay long enough for it to recede.

Who should purchase flood insurance?

Anybody in a flood zone and even then, there are lots of people who flood due to growing urbanization and non-porous surfaces.

What are three of the most common causes of flooding in the U.S.?

1. Poor urban drainage due to growing development. We are constantly speaking with people who say something along the lines of “We have lived here for many years and have never flooded. Now, we have flooded multiple times in the last year.”

If you are waiting for ‘the city’ or the local officials to fix the problem, you are simply killing time until the next flood arrives. Most people who have flooded can be expected to flood again within about 3-5 years, or less, on average.

2. Hurricane storm surges — this speaks for itself.

3. Debris flows associated with wildfire burn scar areas.

4. Bonus — vehicles driving too fast on flooded roadways. I would have never thought about this before getting into flood defense in 2003, but this is a constant problem. Roads get flooded and the flood water is commonly just up to the doors of residential houses. Then, people enjoy driving fast through flooded streets which creates a wave that lap on the front doors of houses and causes flood water to enter the house.

There are many other causes like spring run-off and rising rivers, but those are the most common.

How can flooding impact residential landscaping?

Flooding washes things away and will cover your yard with mud. If you have mulch, it will float away. If you have gravel type rock and the water is moving fast enough, it will also wash that away. If you have loose soils and moving water, you will have erosion. Overall, grass fares really well during a flood.

Also, here is a link for a simple search of flood prone areas in the USA. Insurance companies also help to provide info for similar maps because they are the ones dealing with the claims from flood loss.

Background:

We have multiple exclusive statewide contracts to supply flood barriers as well as the primary U.S. Federal flood barrier supply and technical support contract for when “Uncle Sam” steps in the help.

I have been doing flood defense operations since 2003 and last year we provided about 30 linear miles of flood barriers for governmental, commercial, and residential customers alike.

NOTE: We have the largest variety of flood barriers than any other company in the USA because we believe there is no such thing as the “best flood barrier.” Every flood is different, every location is different, and different situations call for different solutions. This allows us to provide a short list of what we believe to be the best solutions out of a variety of solutions giving the customer the feeling that they made the best decision based on a selection.

If you are in the market for flood barriers, we have found that most flood barrier providers will generally claim that their product is better than all the others. When conducting flood barrier research, and after hearing this from multiple providers, you are not sure who to trust. Therefore, we found it best to have a ‘menu’ of options to choose from with feedback and support in establishing a protective posture that fits your unique situation.

What are the steps for assessing damage after a flood?

At the U.S. Geological Survey, we assess the height of a flooding event by identifying high-water marks and surveying in their locations after the flood has receded. This information provides a way to estimate how much streamflow was in the river at the time of the flood and supplements our real-time monitoring of rivers and streams across the U.S.

More information on how high-water marks are identified and used is here.

For homeowners, this is a different answer, as property damage and infrastructure within and connected to your home may need to be assessed.

What are three of the most common causes of flooding in the U.S.?

This is a complex question because the common causes of flooding in the U.S. generally vary based on the region.

For example, in places in the U.S. where snow falls, snowmelt events or rain-on-snow events are common causes of flooding.

In places prone to tropical cyclones or hurricanes, flooding is a common result.

And yet, for other places, the main causes of flooding could come from downpours resulting from convective storms that also bring lightning and thunder. Understanding the causes of flooding in the U.S. and how they may change in the future is an important, but open, area of research.

What, if anything, can homeowners do ahead of a flood to mitigate damage?

Homeowners can take several proactive steps to mitigate damage from potential floods.

1. First, it’s crucial to understand the flood risk of their property, often available from local government resources or flood risk maps.

2. Elevate structures as well as electrical systems and utilities.

3. Use flood-resistant building materials for renovations, which is known as waterproofing the structure.

4. Installing pumps with battery backups can significantly reduce damage.

5. Additionally, constructing barriers such as sandbags or permanent levees can help deflect water.

6. Homeowners should also prepare an emergency kit and create a family evacuation plan to ensure personal safety.

What are the steps for assessing damage after a flood?

1. After a flood, safety is the primary concern. Homeowners should first ensure that it is safe to return to their property, checking for structural damages like weakened walls and damaged flooring. It’s important to document all damages by taking photos or videos, as these will be necessary for insurance claims.

2. Removing water and drying out the home quickly is crucial to prevent mold growth.

3. Hiring professionals for electrical systems and gas checks is essential before turning on the house’s power and utilities.

4. Finally, contacting insurance companies to initiate claims and arranging for detailed inspections by experts can further aid in the recovery process.

Who should purchase flood insurance?

Flood insurance should be considered by any homeowner or renter residing in areas with a known flood risk, which includes zones designated by the government or insurance bodies as flood-prone.

It is important to note that flooding can also occur outside these designated areas, so it’s advisable for all property owners and renters to consider flood insurance, if applicable. This insurance is especially critical in regions prone to hurricanes, storms, or in areas near water bodies that can overflow.

What are three of the most common causes of flooding in the U.S.?

Three of the most common causes of flooding in the U.S. include:

- Hurricanes and tropical storms.

- Heavy or prolonged rainfall.

- Rapid melting of snow.

Hurricanes and tropical storms can bring intense rainfall and storm surges that overwhelm natural and man-made systems.

Heavy rains can quickly exceed the absorption capacity of soil and the containment of drainage systems, particularly in urban areas.

Lastly, rapid snowmelt in the spring can produce large amounts of water that rivers and lakes cannot contain, leading to overflows.

How can flooding impact residential landscaping?

Flooding can severely impact residential landscaping, from washing away plants and soil to introducing contaminants and pests.

- Saturated soil can suffocate plant roots and lead to the death of grass, flowers, and trees.

- Erosion caused by strong water flows can strip away topsoil and plant nutrients, degrading the quality of the yard and making it difficult for new plants to grow.

- Additionally, floodwaters can deposit harmful chemicals, salts, and invasive plant seeds, potentially leading to long-term issues for the garden and landscape.

To mitigate these effects, homeowners can consider landscaping with native plants that are more tolerant of local flood conditions and using strategic grading to direct water flow away from valuable plants.

Methodology

We identified the 11 most relevant metrics for ranking 2025’s Most Vulnerable Counties for Flooding and grouped them into 4 categories:

- Flood Risk

- Economic Impact

- Population Vulnerability

- Preparedness

Each factor was assigned a weight based on its relative importance. The categories, factors, and weights are listed in the table below.

We then evaluated 943 U.S. counties with a FEMA-designated moderate to very high flood risk using data from the sources listed below the table. Each county received a score (out of 100) for every factor, category, and overall.

A county’s Overall Score is the average of its scores across all factors and categories. The county with the highest Overall Score ranked No. 1 (most vulnerable), while the county with the lowest ranked No. 943 (least vulnerable).

Notes:

- The “Worst” among individual factors may not be No. 943 due to ties.

- Some counties use alternate geographical designations; for example, Baltimore City, Maryland, functions as a separate entity from Baltimore County, and Louisian’s counties are known as “parishes.”

- Coastal Flood Risk, calculated by FEMA, considers the frequency and exposure to coastal floods along with social vulnerability and community resilience metrics.

- Riverine Flood Risk, calculated by FEMA, considers the frequency and exposure to riverine floods alongside social vulnerability and resilience.

- Coastal Flooding Expected Annual Loss, estimated by FEMA, measures the projected financial impact of expected annual building and population losses due to coastal floods.

- Riverine Flooding Expected Annual Loss, estimated by FEMA, measures the projected financial impact of expected annual building and population losses due to riverine floods.

Sources: FEMA, United States Census Bureau, Google Ads, and FEMA National Flood Insurance Program

Protecting Your Lawn From Flood Damage

In 2024, flood-related disasters caused approximately $1.1 billion in U.S. damages, accounting for 0.6% of the total cost from all natural disasters. However, rising sea levels and more frequent extreme weather events mean flood risks are expected to grow in the coming years.

Recent research shows that the Northeast has experienced a 60% increase in extreme rainfall events over recent decades, with cities like New York facing record hourly rainfall and flash flooding in 2025.

Researchers also predict that rising seas will increase severe coastal flooding for about 2.5 million Americans by 2050. Flood events in 2024 caused widespread damage across the U.S., and recent storms in 2025 highlight the growing threat of flooding nationwide.

Only about 4% of U.S. homeowners have flood insurance, leaving many exposed as flood risks rise. With increasing stormwater runoff overwhelming infrastructure, protecting your property and lawn is more important than ever.

Take steps to reduce flood damage and help your lawn recover with our guides below:

- Prevent standing water by improving drainage with swales, French drains, or gutter fixes.

- Check if rainwater harvesting with a rain barrel is legal in your area.

- Install a French drain to improve drainage.

- Watch for lawn diseases after heavy rains.

- Build retaining walls to control runoff.

- Reduce erosion on your property.

- Clean up after a hurricane or other natural disaster.

Hire a local LawnStarter crew to help clean up and restore your lawn after a flood event.

Media Resources

Quotes from LawnStarter Editor-in-Chief Jeff Herman

Here in Dallas-Fort Worth, green ribbons are wrapped around trees in remembrance of those killed in the deadly flash flooding that swept across Kerr County, Texas, and Camp Mystic. Our study uses data from FEMA and other sources, but known flood risks and extreme weather can combine for unimaginable loss.

Part of Texas Hill Country, stretching from San Antonio to Dallas, is known as Flash Flood Alley because of its steep terrain, shallow soil, and roughly once-a-decade drenching, monsoon-like rains.

Knowing you live in a flood zone, you can be more prepared, at least for annual flooding like along the Mississippi River near St. Louis, where I grew up. That’s why this study story highlighting flood risk is important.

These are some additional bullet points about flood risk, flood insurance, and “ghost forests”:

- 7 of FEMA’s 10 highest river-flood-risk counties lie in Louisiana and Texas, but Shelby County, Tennessee (No. 21), Miami-Dade County, Florida (No. 143), and Washoe County, Nevada (No. 91), highlight significant flood threats beyond the Gulf Coast.

- Counties like Alexander, Illinois (No. 129), and Carter, Missouri (No. 198), show high Google search interest in flood insurance. These areas face rising flood risks, with home abandonment near the Mississippi River running roughly 30% above the national average.

- Saltwater is killing coastal woodlands and leaving behind eerie “ghost forests,” a warning sign of rising seas, from Beaufort County, South Carolina (No. 456), to Tillamook County, Oregon (No. 69).

- Florida has the best access to flood insurance providers, with 31. However, only 13% of Sunshine State residences are insured against flooding.

- Only 7 West Coast counties cracked the top 50, including Coos (No. 14) and Clatsop (No. 36) counties in Oregon, along with California’s Marin (No. 23), Kern (No. 28), Modoc (No, 29), Humboldt (No. 32), and San Bernardino (No. 49).

- Flash flood danger spans every elevation. Mountain counties in western North Carolina, Buncombe (242), Haywood (No. 458), and Madison (No.582) soaked up more than 14 inches of rain during Hurricane Helene.

2024’s Most Vulnerable Counties for Flooding Ranking Results

Main Photo Credit: Hurricane Ian flooded houses in Florida residential area: bilanol / Adobe Stock / License