When you’re hustling to finish your federal tax return, you might be overlooking a tax deduction that’s right in your front yard — literally. Is landscaping tax deductible?

- Lawn Care Can Be Deducted

- Tax Court Rulings on Lawn Care

- A Path to the Home Office Deduction

- IRS Home Deduction Guidelines

- List of Tax Deductions for a Lawn Care Business

- Finances of People Who Run Landscaping Businesses

- Landscaping Employment in the U.S.

- Taxes You Will Owe

- Nine Tax Deductions for a Lawn Care Business

- Equipment Costs for Landscaping

- FAQs

Lawn Care Can Be Deducted

Lawn care expenses can be deducted on your federal tax return if you maintain a home office, according to Crystal Stranger, author of The Small Business Tax Guide.

In deducting lawn care expenses related to your home office, Stranger says:

- You can write off only a portion of your lawn care. For example, if your house covers 2,000 square feet and your home office takes up 200 square feet, you’d be able to take a 10 percent deduction for the cost of lawn care.

- The space set aside for your home office must be used “both regularly and exclusively” as an office.

- You might be able to deduct all your lawn care-related expenses if your home serves as a calling card for your business and a promotional sign is posted in your front yard.

Tax Court Rulings on Lawn Care

The U.S. Tax court has sided with taxpayers in several cases concerning deductions for lawn care expenses:

- A dentist who used one-third of his home as an office for his dental practice was allowed to deduct one-third of his landscaping expenses. The 1987 case is cited by Pappu Khera, of the accounting and tax firm Khera & Associates in Odenton, MD.

- A woman running a daycare center at her home was able to deduct part of her lawn care expenses due to a 1990 ruling.

- A sole proprietor who met with clients on a regular basis in a home office was allowed to deduct a portion of his landscaping costs.

- Deductions for part of the costs of lawn care (such as mowing) and driveway repairs have been allowed.

A pro’s tip: Tax deductions for a residence that includes a home office is not a cut-and-dried issue. “Lawn care is actually one of those hotly contested items for deductibility,” Stranger says. With that in mind, it might be wise to use a professional to prepare your taxes.

The Internal Revenue Service states in Topic No. 509 Business Use of Home, “In general, you may not deduct expenses for the parts of your home not used for business, for example, lawn care.” But the Tax Court has made its rulings, which might be why the IRS document states “In general.”

A Path to the Home Office Deduction

When can you apply tax write-offs to a home office? One way to tell, according to the IRS, is if come tax time you answer yes to these questions:

- Is part of your home used in connection with a business?

- Is the use regular and exclusive?

- Is it your principal place of business?

- Do you meet patients, clients, or customers in your home?

IRS Home Deduction Guidelines

The Internal Revenues Service provides home deduction information in Publication 587. It includes this information:

Types of Expenses

| Expense | Description | Deductibility |

| Direct | Expenses only for the business part of your home. | Deductible in full. |

| Indirect | Expenses for keeping up and running your entire home. | Deductible based on the percentage of your home used for business. |

| Unrelated | Expenses only for the parts of your home not used for business. | Not deductible. |

Source: IRS

List of Tax Deductions for a Lawn Care Business

As a self-employed person, if you own a landscaping business, you are in line for these deductions:

- Self-employment tax. About half of the 15 percent you pay in self-employment tax (which covers Social Security and Medicare) is deductible.

- Wages. Whether these are for full-time employees, free-lancers, or contractors, you can deduct their wages from your taxes.

- Home office. Even if it is a room in your house, you can write off the expenses (internet, furniture, computer, supplies).

- Equipment and supplies. Whether it is a purchase you would make every few years (such as a lawnmower) or a regular expense (fertilizer), you are in line to include it on your taxes.

- Postage. Those invoices you mail? You can have a write-off.

- Rent. If you rent office space, or storage space just for the business, you can write it off.

- Utilities. Electricity, water, gas and heat for the portion of your home being used for the business is eligible for a deduction.

- Car expenses and mileage. These can be a large deduction. But you will want to keep track of your mileage and get receipts for gas.

- Business insurance. The premiums can be deducted.

Finances of People Who Run Landscaping Businesses

The wages of people running landscaping businesses, according to the U.S.Bureau of Labor Statistics:

| Employment | Average hourly wage | Average annual wage |

| 116,380 overall | $25.61 | $53,270 |

The incomes of people running landscaping businesses:

| Hourly Wage | Annual Wage | |

| 10% of the workers | $16.63 | $34,600 |

| 25% of the workers | $18.69 | $38,880 |

| 50% of the workers | $23.46 | $48,800 |

| 75% of the workers | $29.90 | $62,200 |

| 90% of the workers | $37.93 | $78,880 |

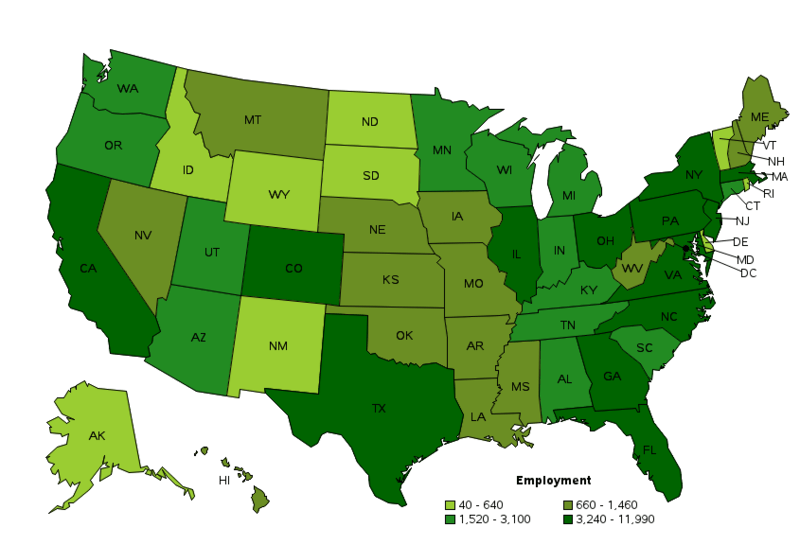

Landscaping Employment in the U.S.

Taxes You Will Owe

If you are running a landscaping business, either full- or part-time, you can expect to owe these Federal taxes:

- Federal income tax

- Self-employment taxes (for Medicare and Social Security, about 15.3 percent)

- State income tax

- Sales tax, in most states

- Sales tax on products you sell, such as fertilizer or hoses. This, too, will vary by state.

Nine Tax Deductions for a Lawn Care Business

- Travel expenses. You have to keep a log of them to meet IRS requirements. Then you can deduct the expenses or you can deduct the standard mileage rate. In 2022, this rate was 62.5 cents per mile.

- Insurance. The IRS allows you to deduct any insurance on your vehicles and equipment and any liability insurance. In addition, employee health insurance premiums can be written off as an income adjustment using IRS Form 1040’s Schedule 1.

- Vehicle and equipment maintenance. You can deduct expenses for vehicle and equipment repair, unless you claim car and truck expenses.

- Equipment rental or lease. You will need receipts.

- Equipment depreciation. An accountant can calculate the depreciation expense for each piece of machinery.

- Home office. IRS guidelines are that the room has to be exclusively for your business.

- Advertising. Any money spent on advertising is deductible.

- Contractor expenses and employee wages. This includes other payments related to their work, such as Social Security payments on Schedule C.

- Legal and professional services. Think lawyers and accountants. Plus any other such services.

Equipment Costs for Landscaping

Can you write off a lawn mower on your taxes? If you start a landscaping business, you can write off 30 percent of the cost of a lawn mower up to $7,500. As a business owner, other costs may be tax deductible

LawnStarter has done an analysis of basic equipment costs:

| Equipment | Cost |

| Walk-behind lawn mower Riding lawn mower | $1,000-$5,000 $6,000-$10,000 |

| String trimmer | $100-$400 |

| Leaf blower | $250-$500 |

| Rakes, spades, loppers, etc. | $10-$50 each |

| Fertilizer spreader | $100 |

| Hedge trimmer | $150 |

| Aerator | $250 |

| Chain saw | $250 |

| Pressure washer | $800 |

FAQs

According to the website of the U.S. Tax Court, its mission “is to provide a national forum for the expeditious resolution of disputes between taxpayers and the Internal Revenue Service. … and to ensure a uniform interpretation of the Internal Revenue Code.”

When it comes to rental property tax deductions, all maintenance — including lawn care — is fully deductible as a business expense. “This [part of the tax code] is quite straight-forward,” tax author Crystal Stranger says.

A farm is defined by the IRS as a business that undertakes farming activities and produces income. That income can be filed on Schedule F of Form 1040, which is headlined Profit or Loss from Farming.

The IRS further defines this in the Farmer’s Tax Guide, IRS Publication 225: “You are in the business of farming if you cultivate, operate, or manage a farm for profit, either as owner or tenant. A farm includes livestock, dairy, poultry, fish, fruit, and truck farms. It also includes plantations, ranches, ranges and orchards.”

The U.S. Bureau of Labor Statistics (BLS) uses this definition: “Directly supervise and coordinate activities of workers engaged in landscaping or groundskeeping activities. Work may involve reviewing contracts … ; answering inquiries from potential customers regarding methods, material, and price ranges; and preparing estimates.”

A Call to Action

There are deductions to be had when it comes to lawn care, but it isn’t an easy path to take. You can review the question as a DIY project if you have the time and the willingness to make your way through tax forms, or you can have a CPA or similar expert do it.

A pro’s tip: Often the CPA/expert will find more than enough deductions to cover any fee.

If you want to earn a new tax deduction for your home office, business, or rental property, contact LawnStarter today for a quote on highly-rated, professional landscape experts in your area.

Disclaimer: This information is for educational purposes only. Consider consulting a professional for assistance with your tax return.

Additional sources: Next Insurance

Main Image Credit: Simon Cunningham / Flickr / CC BY 2.0