Most entrepreneurs open their small businesses with enthusiasm, but the challenge of keeping them in the market drains their energy. In fact, in their first year of business, a fifth of small businesses fail, with half of them failing within five years.

Small Business

Statistics & Trends

2023

in the US

Despite having fewer employees and customers than the average large business, small businesses have a significant presence in our economy, promoting innovation, expanding opportunities and driving job creation. Following pandemic-related large shutdowns, changes in operations, and even entire overhauls of small enterprises, these businesses will confront new problems in the coming years.

Lawnstarter put up a list of significant facts and trends that small business owners should be aware of in 2023. To extract relevant and helpful recommendations that may be applied to nearly any sort of business, information was gathered from economy specialists, government papers, market research, and financial news.

Shop Small

Small Business Saturday

As consumer spending continues to recover, consumers in local communities turned up in droves for Small Business Saturday on November 27.

Since American Express first launched the movement in 2010, consumer have spent an estimated $163 billion at small businesses on Small Business Saturday. This year, thousands of Americans from all 50 states participated in Small Business Saturday in their local communities.

American Express predicts that $0.67 of every dollar spent at a small company stays in the local community. This has the potential to increase sales during the 2022 holiday season.

What is Small Business Saturday?

Small Business Saturday is an American shopping holiday falling neatly between Black Friday and Cyber Monday, boasting one of the year’s busiest shopping weeks. Small Business Saturday is mainly an inspirational holiday or a rally for supporting small businesses in local communities over big-box retailers or Amazon.

The day gained popularity, owing primarily to the Shop Small Movement, and was acknowledged by the US Senate in 2011. It has increased since then, with 2020 having record sales increases of more than 500% and revenue growth of 300%.

Being close to end-of-the-year holidays, SBS sales are expected to skyrocket. In 2022, projections expect for holiday retail sales to reach an all-time high ($960.4 billion). Up to $224.31 billion will be targeted for online purchases.

Local Support

Supporters bring their community together with events and activities on Small Business Saturday and throughout the year.

Small Adds Up

The dollars you spend at a local business in your community can add up and go back to the community.

Product Diversity

Small businesses have just as much access to vendors (who also determine pricing, not stores) that big box businesses do.

Making an Impact

For every cup of coffee bought from your neighborhood cafe or gift from a local artist's online store, you are buying small and making a difference.

Small Business

Saturday Statistics

$23.3 billion were spent at SBS

American Express 2021 Small Business Saturday Consumer Insights Survey reported that spending among U.S. consumers who shopped at independent retailers and restaurants on Small Business Saturday reached an estimated $23.3 billion, an increase of 18 percent from $19.8 billion in 2020. More than 51 million people participated in the SBS.

58% of shoppers shopped online

A major source of revenue for small businesses, was somewhat higher on the day, with 58% of customers making an online purchase, up from 56% in 2020 and 43% in 2019.

SBS is critical for small businesses

More than half (56%) of small businesses believed that this year's Small Business Saturday was more important than ever for their company, and 78% believed that holiday sales will effect their ability to remain open in 2022.

70% of respondents would recommend others to shop small

Small Business Saturday turned out to be inspiring, with 70% of respondents reporting that they would recommend others to buy at small, independently-owned retailers.

Local Support

Supporters bring their community together with events and activities on Small Business Saturday and throughout the year.

Small Adds Up

The dollars you spend at a local business in your community can add up and go back to the community.

Product Diversity

Small businesses have just as much access to vendors (who also determine pricing, not stores) that big box businesses do.

Making an Impact

For every cup of coffee bought from your neighborhood cafe or gift from a local artist's online store, you are buying small and making a difference.

General Small

Business Statistics

There is never a dearth of small businesses in the US. There are millions of them, and the number fluctuates on a regular basis as thousands close and others open.

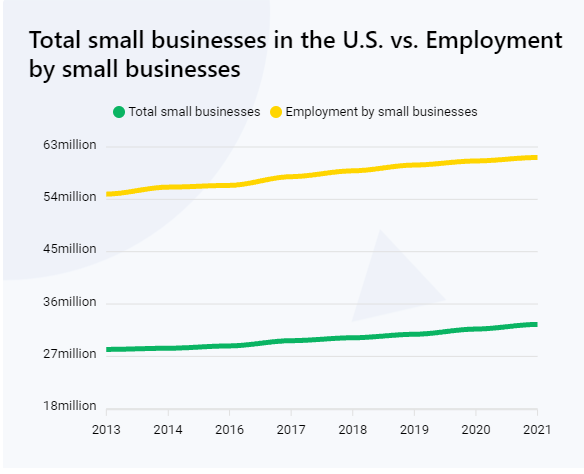

By December 2021 there were a total of 33.2 million small businesses in the U.S., accounting for 99.9% of all private establishments.

Small businesses have an estimated 61.7 million employees, making up a whopping 38.85% of all employees in the United States. Still, 81% of small businesses have no employees.

Total small businesses in the U.S. vs. Employment by small businesses

Between March 2019 and March 2020 1 million new small businesses came into existence, while 909,808 closed their doors, enjoying a year over year (YoY) net increase of 42,650 businesses.

The typical landscaping business has 2 employees, while the industry as a whole employs over 1.2 million people.

Small business count by size and industry

The industries listed below have the highest number of small businesses and employees operating in the US.

Professional, Scientific, and Technical Services account for 4.5 million small businesses with 3.7 million employees.

Construction

Construction is another top industry employing 2.6 million employees. Construction has 3.3 million SMBs currently operating in the US.

There are over 3.1 million small businesses in real estate, rental and leasing employing more than 2.8 million employees.

Administrative, Support, and Waste Management industry has 2.8 million SMBs and over 2.5 million employees

There are over 2.5 million employees working in transportation and warehousing employed by 2.7 million small businesses.

Other Services (except Public Administration) have a whopping 3.6 million SMBs, with one-tenth being landscaping businesses. In total, Other Services employ 2.9 million people.

500 employees

Small businesses with fewer than 500 employees accounted for 99.7 percent

100 employees

Small businesses with fewer than 100 employees accounted for 98.1 percent

20 employees

Small businesses with fewer than 20 employees accounted for 89.1 percent

10 employees

Small businesses with fewer than 10 employees accounted for 78.5 percent

Why entrepreneurs choose to open

their small business?

There are probably as many motivations to start a small business as there are business owners, yet many people start their businesses for similar reasons.

People are driven to start their own business for a variety of reasons. Among the most frequent reasons for starting a business, 29 percent of respondents stated that they wanted to be their own boss, which remains from year to year, one of the most popular motivations.

The next most popular reason for starting a new small business includes the dissatisfaction with corporations with 17% choosing this as their primary motivation. Other frequent reasons include the drive to pursue passion (16 percent) and the opportunity presented to start the business (12 percent).

Small Business

Financial Statistics

To start up a new business or expand an existing one, small businesses owners need access to funds to keep their firm running. However, as most small business owners know, getting the funds is not an easy thing. In fact, one-third of small businesses do not have access to financing.

On top of that, the pandemic hit small businesses the most, with most business owners admitting they have cash flow problems. Almost half of the business owners are unsure if they will rebound after the pandemic.

40% of Small Businesses Are Profitable

It's one thing to hit the ground running as a small business owner, but it's quite another to master the art of small business management. Only 40% of small firms are successful, or make money after all expenses are deducted.

70% of small businesses are in some kind of unpaid debt

Many small businesses take out loans to boost sales. According to small business debt data, 21% of them are in debt between $25,000 and $100,000, while 17% are in debt between $1 and $25,000.

Entrepreneurs need $15,000 to start a business

The amount of capital required to establish a business is determined by the size of the company. A $3,000 investment is required to start a microbusiness, but the investment can go up to $15,000.

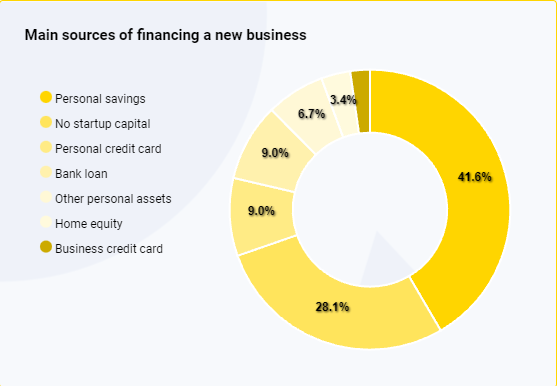

Main sources of financing a new business

Small business owners have two options to finance a small business: get a loan or use their private equity.

In the pre-pandemic days, 82% of the small businesses used their equity to finance their new businesses, while one in five small firms used them to expand their business.

In starting a new business, a quarter of small firms said they don’t need start-up capital. The behavior is more prevalent in nonemployers and home-based operations, which require little to no capital investment.

with financing due to Covid-19

With the pandemic still rolling, the number of new small businesses opened shrank. In 2020, only 4.4% of entrepreneurs applied for a loan to open a new company.

With less cash going in and out, small businesses sought various financial means to stay afloat. In 2021, 62.1% of small businesses applied for a loan, with one-fifth of them doing it to survive during COVID-19. Line of credit was the most frequent loan, with one in four small businesses relying on it.

The drop in spending during the pandemic was the number one effect on small businesses. In June 2020, 64% of firms reported reduced customer demands for their products, resulting in lower revenues.

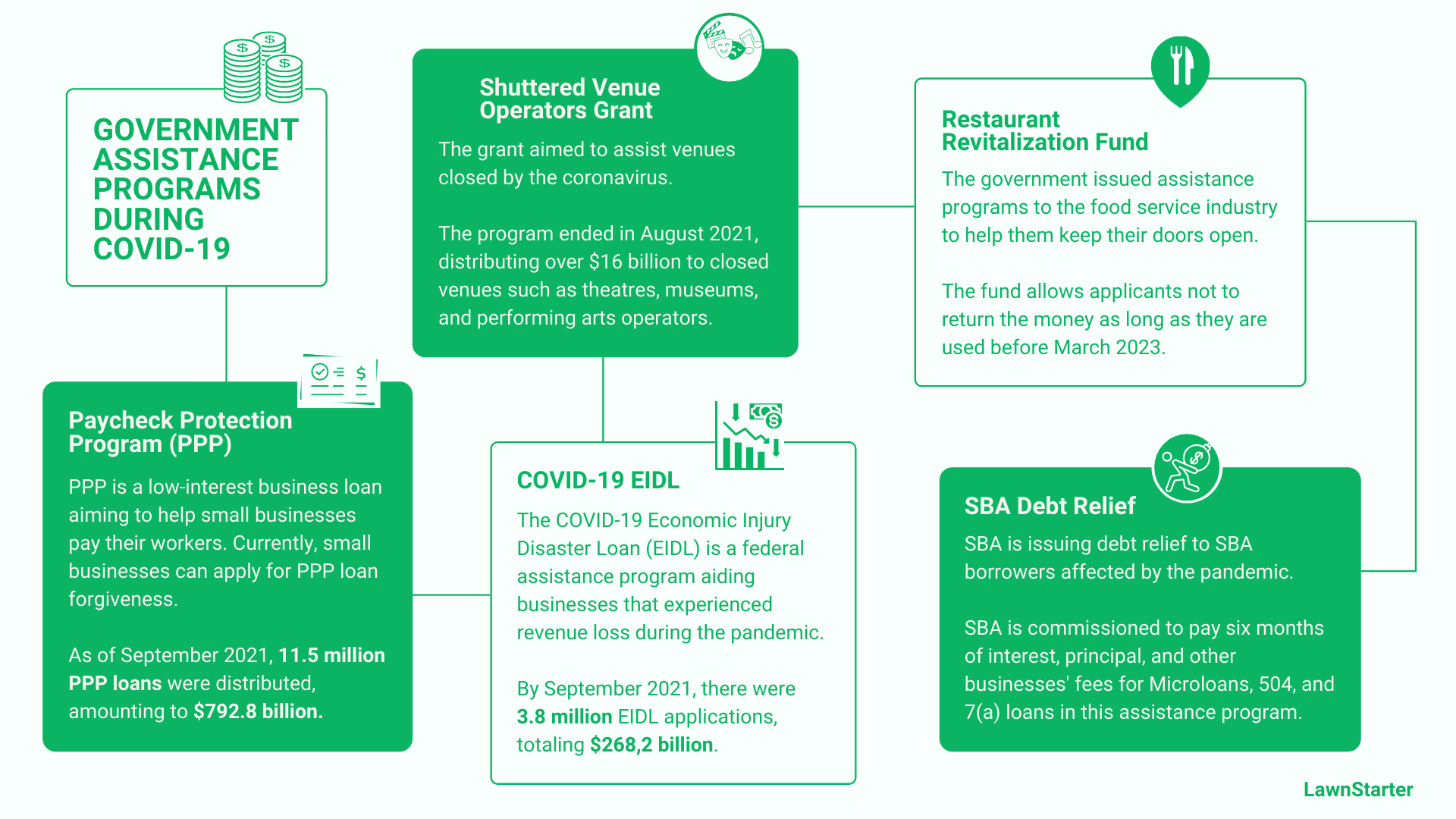

During these unprecedented times, small businesses relied on government support to keep their businesses running. In 2020, 80% of small businesses report applying for government COVID-19 assistance programs.

Besides borrowing from banks and other financial institutions, a third of small business owners used personal credit cards to cover their business costs.

Small business loan financing in 2020

CHAPTER 3

Small Business Success and

Failure Statistics

Running a business is hard work. Most business owners know that they have to deal with financing, managing, and promoting their product or service to their target market on any given day, among other things. External challenges that come every day add up to the fatigue of keeping the business alive. That’s why one in five small businesses fail within the first year, a percentage that doubles in four years. After fifteen years, 3 out of 4 small firms are out of the market.

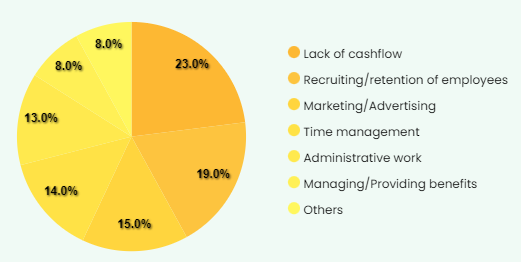

In 2021, as the pandemic progresses, small businesses face numerous challenges, with a lack of cash flow and marketing being the most recurring ones.

20% of small businesses fail within the first year

Most entrepreneurs open their small businesses with enthusiasm, but the challenge of keeping them in the market drains their energy. In fact, in their first year of business, a fifth of small businesses fail, with half of them failing within five years.

30% of small businesses fail in the second year

About 30% of small businesses will survive their second year in business. This means that there is a lot of uncertainty ahead of new entrepreneurs getting ready to start a firm or business owners who have recently opened your doors.

50% make it past their fifth birthday

Only half of small businesses survive five years, with the percentage varying from 45.4 percent to 51 percent depending on the year the business was founded.

After 15 years, one out of four firms is still operating

Only about one in four small businesses get to the 15-year mark and live to tell the tale.The reasons for failure vary among industries. However, one that most often happens is the inability to create and follow an effective business plan.

About 30% of small businesses will survive their second year in business. This means that there is a lot of uncertainty ahead of new entrepreneurs getting ready to start a firm or business owners who have recently opened your doors.

Only half of small businesses survive five years, with the percentage varying from 45.4 percent to 51 percent depending on the year the business was founded.

Only about one in four small businesses get to the 15-year mark and live to tell the tale.The reasons for failure vary among industries. However, one that most often happens is the inability to create and follow an effective business plan.

Cash flow was always a problem for small businesses. In pre-pandemic times, 29% of companies failed because of cash flow problems.

With the pandemic hitting small businesses the most, cash flow and lack of capital became their central problem. In 2021, 23% of small business owners said cash flow was their main challenge.

With revenues gaps getting lengthier and more frequent, small businesses lack the funds to keep the staff, run operations, and invest in new processes to adapt to government restrictions. With less money going in and out, small businesses risk setting the key to their businesses for good.

Marketing was challenging for small businesses for a long time. However, in 2020, 15% of small businesses struggled with marketing and advertising, a seven percent increase from the previous year.

The marketing problems for small businesses start from the fact that most business owners are running marketing projects. Marketing in itself is a wide-ranging responsibility to be added on top of other operational roles the business owners hold.

Small businesses reported limited marketing budgets and extensive resources needed to keep an online presence as their central marketing challenges in 2020.

CHAPTER 4

Small Business Technology and

Marketing Statistics

In the digital world we live today, being present online is crucial for the success of a small business. Small businesses that continuously invest in marketing—especially digital marketing— experience an increase in revenues. For a small business, the marketing journey in the online world starts with a website, while social media continues to be a big player in driving revenues for small businesses. However 28% of small businesses don’t have a website.

More than reaching new markets, investing in technology helps small enterprises enhance communication with customers and increase efficiency.

Regardless of the sort of small business, 84% of owners use at least one major digital channel to do business. Producing, selling, and promoting all leave a significant digital imprint.

84% of small businesses use at least one major digital platform to provide information to customers.

80% use at least one major digital platform to showcase and market their products and services.

79% of small businesses use technological tools to connect with consumers and suppliers.

75% of small businesses in the US use technology platforms for selling their products.

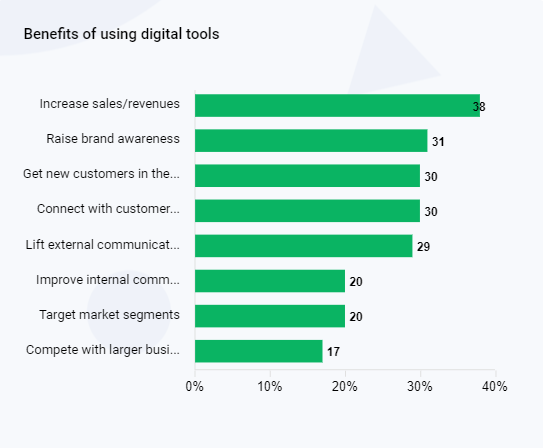

Benefits of using digital tools

More than reaching new markets, investing in technology helps small enterprises enhance communication with customers and increase efficiency. Yet, eight out of ten small businesses are not making use of technology and online channels.

Digitalization created new growth opportunities for small businesses. Today, a small business operating in Texas with a web presence such as social media and e-commerce can reach new global markets. The expanded audience allows small firms to compete with larger companies and innovate with new product offerings. As U.S. small businesses advance their level of digital engagement, they experience an additional 11 percent growth in revenue.

55% use technology for communication

55% of small businesses in the U.S. use technology to communicate with their customers and prospects.

41% use technology to increase revenues

Though social media is perceived as a tool to increase brand awareness, 41 percent of small businesses use it to increase revenues

81% of customers research online

Having a website increases the visibility of businesses, knowing that 81% of customers research online before making a purchase.

78% are optimistic about their future

78% of small business owners reported that they were optimistic about the future of their businesses.

CHAPTER 5

Small Business

Demographic Statistics

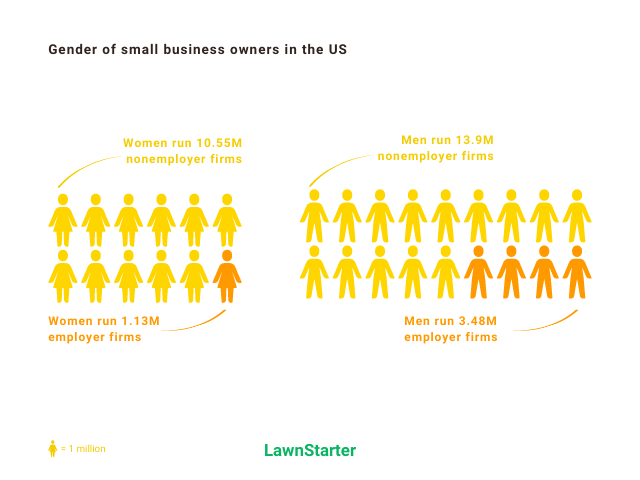

Small business ownership is saturated between different minority groups. The most recent census data show women own almost half of small businesses in the US, though they tend to lead more nonemployer firms. In contrast, male small business owners have the largest share of employer companies.

Minority groups are also underrepresented in employer firms, with one in nine minority-led small businesses employing other people. Among minorities, Asians businesses have the largest share of employees.

Almost half of the small businesses in the US are owned by women. Yet, they account for only 14% of total sales. In comparison, 36.8% of small business owners in Canada (North America) are women.

Nonemployer firms continue to be a favorite for American women, with over 90 percent running one—the percentage drops by ten percent for men who have a nonemployer business.

Employer firms led by men are the most profitable ones as they account for 87% of all sales by employers firms across the country.

Seventy-two percent of all small businesses are owned by White-Caucasians, out of which one in five is an employer firm. However, employer firms account for 92% of sales from firms led by white-Caucasians, making them the most profitable group of small businesses among all race groups.

The largest minority group of business owners are Hispanics, with 3.96 million businesses across the US. They are followed by African-Americans who own 3.08 million small businesses or 9 percent of all small businesses.

Small businesses led by Asians turn out to be the most profitable ones among minority groups. According to the U.S. Census Bureau, in 2017, they totaled $908.9 billion in sales, almost four times higher than African-American businesses.

Seventy-two percent of all small businesses are owned by White-Caucasians, out of which one in five is an employer firm. However, employer firms account for 92% of sales from firms led by white-Caucasians, making them the most profitable group of small businesses among all race groups.

The largest minority group of business owners are Hispanics, with 3.96 million businesses across the US. They are followed by African-Americans who own 3.08 million small businesses or 9 percent of all small businesses.

Small businesses led by Asians turn out to be the most profitable ones among minority groups. According to the U.S. Census Bureau, in 2017, they totaled $908.9 billion in sales, almost four times higher than African-American businesses.

Small business owners age

The share of young business owners has been increasing over the years. The latest Census data show that one in five business owners is younger than 35 years old, with 95% of them running nonemployer firms. This comes as no surprise, as freelancing became the trend of the last decades. In 2020, over 59 million freelancers were in the market, with 94% being younger than 38 years old.

However, the largest share of small businesses comes from people 35 to 54 years old. Among 12.6 million businesses they own, one in six is an employer firm.

On the other hand, business owners 55 years and older dominate the employer firms market, owning almost half of them.

“What began nine years ago as an effort to support local stores during the holiday shopping season has become the Shop Small movement, bringing together millions of shoppers, small businesses of all kinds, civic leaders and organizations in thousands of towns and cities across the country,

CHAPTER 6

Small Business & COVID-19

When COVID-19 swept the world in 2020, it came with implications bigger than the healthy ones. It eventually created an economic crisis, hitting small businesses the hardest. COVID-19 sent the US economy into recession after ten years of expansion. With a third of small businesses being shut, millions of Americans were out of their jobs. In six months, the unemployment rate tripled from 3.6 percent to 13 percent.

Amid the crisis, the US government created COVID-19 relief funds to help small businesses affected by the pandemic. Now small firms are looking their way forward to recover from pre-pandemic days. However, recent analysis reveals it may take five years or longer for a small business to recover fully.

COVID-19 disproportionately affected small businesses, forcing nearly a third of them to close. Some firms closed temporarily, others closed their doors forever.

Businesses that stayed in the market faced challenges of all sorts. As the economy hit the recession, many firms faced reduced demands for their products and services. A part of them had to adapt to new client expectations, and almost all had operational changes due to health and safety precautions.

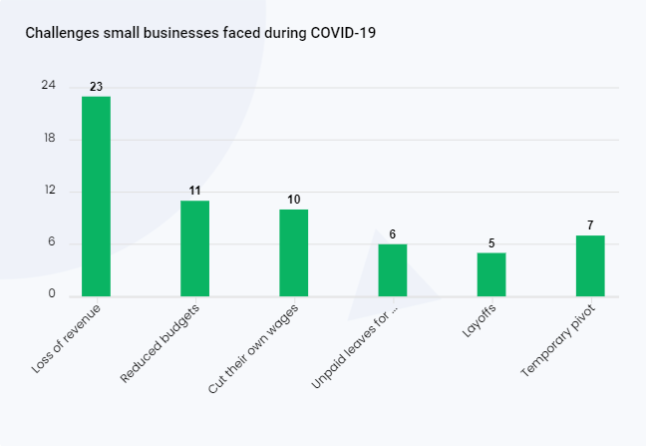

Among other challenges small businesses faced during the pandemic were loss of revenues, reduced budgets, and cuts on their own wages.

Challenges small businesses faced during COVID-19

As the government eased the COVID-19 restrictions and issued government assistance programs, the unemployment rate slowly started to level up, reaching 6.7 percent at the end of 2020.

Since the great recession of 2007, the economy has been flourishing, enjoying a low unemployment rate. In the last quarter of 2019, the unemployment rate reached 3.6 percent—the lowest in 20 years. The economic expansion continued in the first two months of 2020, seizing 128 months of growth, making it the US’s most protracted financial growth period.

However, everything went in reverse when the pandemic forced millions of Americans out of their jobs, tripling the unemployment rate to 13 percent by June 2020. The increase in unemployment was the highest since the great depression, leaving 20.6 million people out of their jobs.