Survey: Many Houston Homeowners Saddled With Relatively High Mortgage Rates

by John Egan

January 24, 2017

For some homeowners in the Houston, TX, metro area, mortgage interest rates are practically as high as an in-flight rocket.

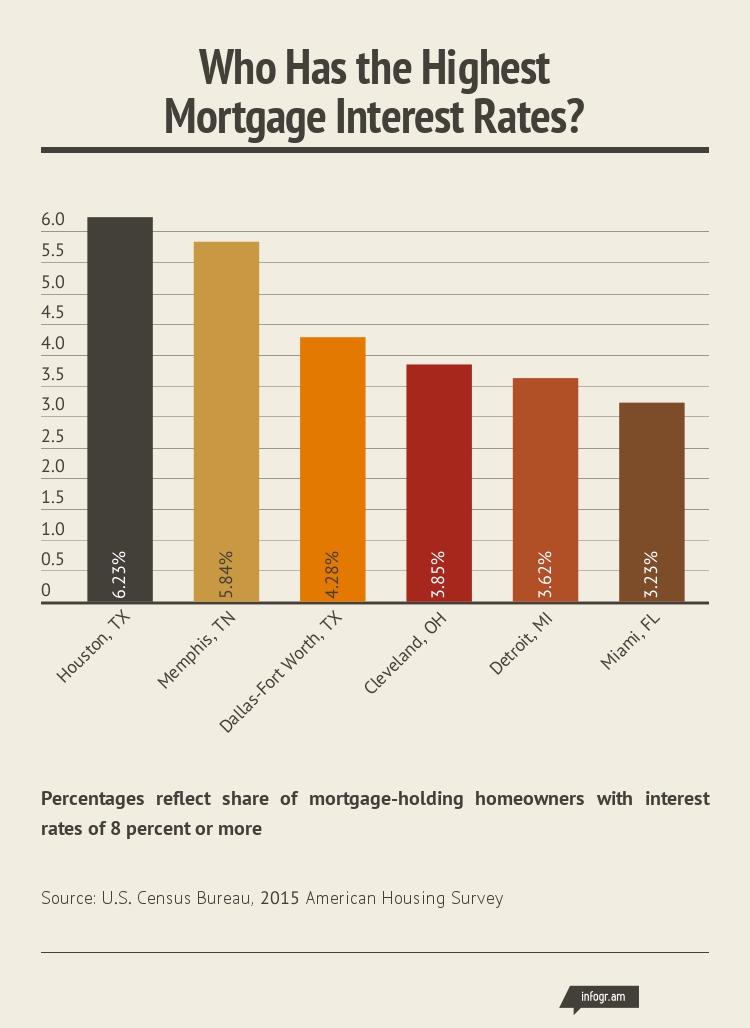

Among the 25 major metro areas included in the U.S. Census Bureau’s 2015 American Housing Survey, Houston had the largest share of homeowners with mortgage interest rates of at least 5 percent -- nearly 4 of every 10 homeowners (39.9 percent). Of the region’s mortgage-holding homeowners, 6.2 percent had loan interest rates of 8 percent or more, a LawnStarter analysis of the Census Bureau data shows. For all 25 metro areas, that was the highest share in the 8-percent-and-over category.

The Census Bureau released data from the 2015 American Housing Survey in January 2017. Figures for interest rates apply only to owner-occupied homes.

The Houston area has a relatively high share of home loans with interest rates of at least 8 percent.

Photo: YouTube/NewHomeSource

8 Percent vs. 4 Percent

So, what does an 8 percent rate look like vs. a 4 percent rate?

According to a mortgage calculator on the website of the United Bank of Union in Union, Missouri, borrowing $200,000 at a fixed rate of 8 percent rate over 30 years would result in a monthly payment of $1,468, with total payments of $528,310 (principal and interest). By comparison, borrowing $200,000 at a fixed rate of 4 percent rate over 30 years would lead to a monthly payment of $955; total payments would be $343,739 (principal and interest). The difference between the two scenarios: nearly $185,000.

Casey Fleming is author of “The Loan Guide: How to Get the Best Possible Mortgage.”

Time to Refinance?

Of course, since the survey was taken in 2015, some Houston-area homeowners with high-interest mortgages probably have nailed down lower rates through refinancing.

However, if your interest rate still is hovering above 4.5 percent for a traditional 30-year, fixed-rate mortgage, it might be worth looking into refinancing, particularly since mortgage rates are on the rise, according to mortgage adviser Casey Fleming, author of “The Loan Guide: How to Get the Best Possible Mortgage.”

“If you are paying over 4.25 percent for a mortgage, it is likely that you had a bad credit score during the time of purchase or simply had no idea how to shop for a loan,” says Evan Harris, co-founder of real estate lender SD Equity Partners.

Harris says mortgage interest rates, especially for new buyers, almost always depend on the type of home loan and the credit score of the buyer.

Add me to your site!

Add me to your site!

Mortgage Rates ‘Still Quite Low’

Although the interest rates for Houston-area homeowners might seem out of whack, the experts at Zillow, an online marketplace for residential real estate, say borrowing costs for homeowners “are still quite low by historical standards.”

Based on data going back to 1971, the average mortgage interest rate in the period since then is 8.3 percent, according to Zillow. Therefore, interest rates below 6.5 percent could be considered low, rates from 6.5 percent to 9 percent could be viewed as average, and rates above 9 percent could be described as high, Zillow says. As of late January 2017, the average interest rate for a traditional 30-year, fixed-rate mortgage ranged from 4 percent to 4.5 percent.

“But if you feel that your mortgage is too high and see lower rates on similar loans, it might be time to refinance,” Harris says.

Related Posts

Houston, We Have a Safety Problem: Many Homes Not Properly Childproofed

What Will Houston Look Like in 2020?

Houston’s Water Woes

LawnStarter is Houston's most convenient lawn care service

Easy 5 minute booking

Houston's top-rated lawn pros

Online account management