Homeownership is an important milestone for Americans — and good reason. Ditching an apartment and home buying provides far more independence, especially after it’s fully paid off (down payment included). Just make sure you get a home inspection!

Americans like owning their own living space. The last U.S. Census, conducted in 2009, found that people that owned homes occupied almost 70 of all housing units.

But with more freedom comes more responsibility, and that can mean a lot of unexpected bills. Homeowners who take pride in their property want to keep it up for as long as they can, but that means paying attention to things you might not have thought about as a renter.

So, what are the biggest challenges associated with homeownership today? Some of these problems present themselves before a buyer is even fully moved in. Our study on home purchases challenges identified a lot of surprises. My personal dread is dealing with the real estate agents and worrying about my credit score.

Damage Control

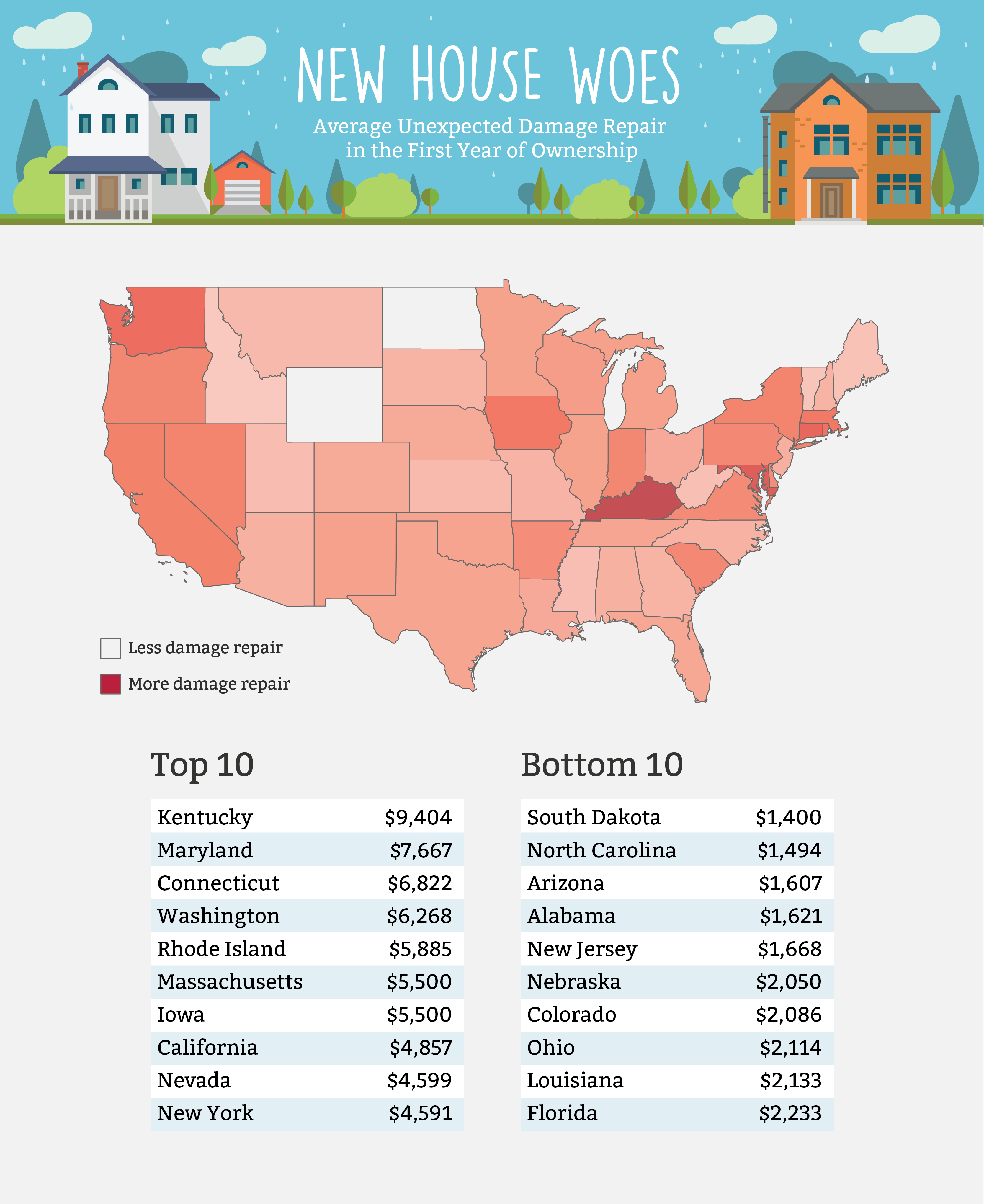

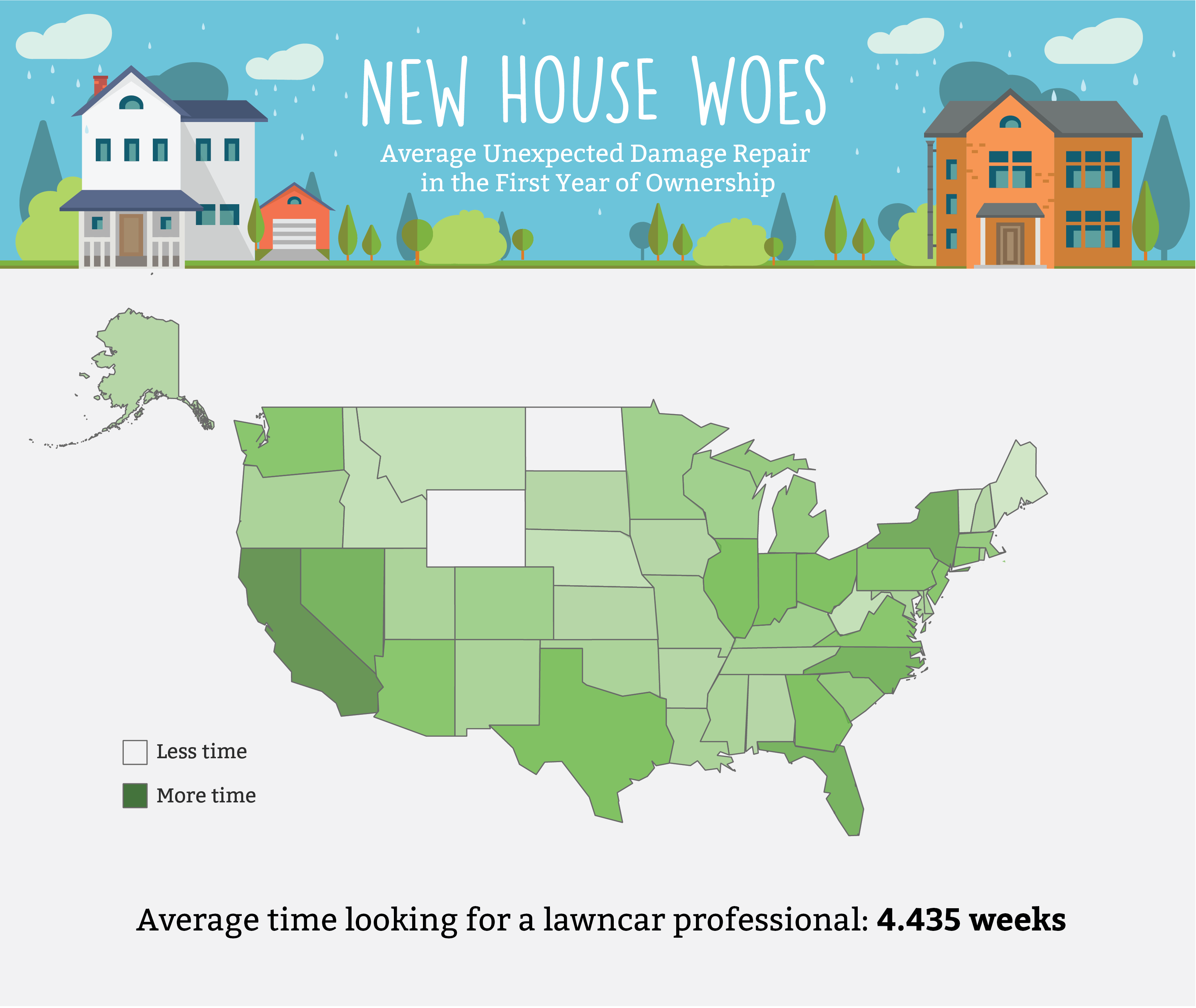

No one wants to shell out even more cash for repairs this early on into homeownership, but it does happen, and prospective homeowners need to be prepared for that. As it turns out, these expenses can vary depending on where you live. Make sure you hire a home inspector as well as a realtor.

Our study found that residents living in coastal states can expect to see the highest levels of damage repair during the first year of homeownership. However, Kentucky stood out as being the most expensive. This may be one of the reasons why residents have been leaving the state in droves, especially since the “Great Recession” of 2008 and 2009. Another way to avoid costly repairs is to buy new construction from home builders.

Why Buy THIS Home?

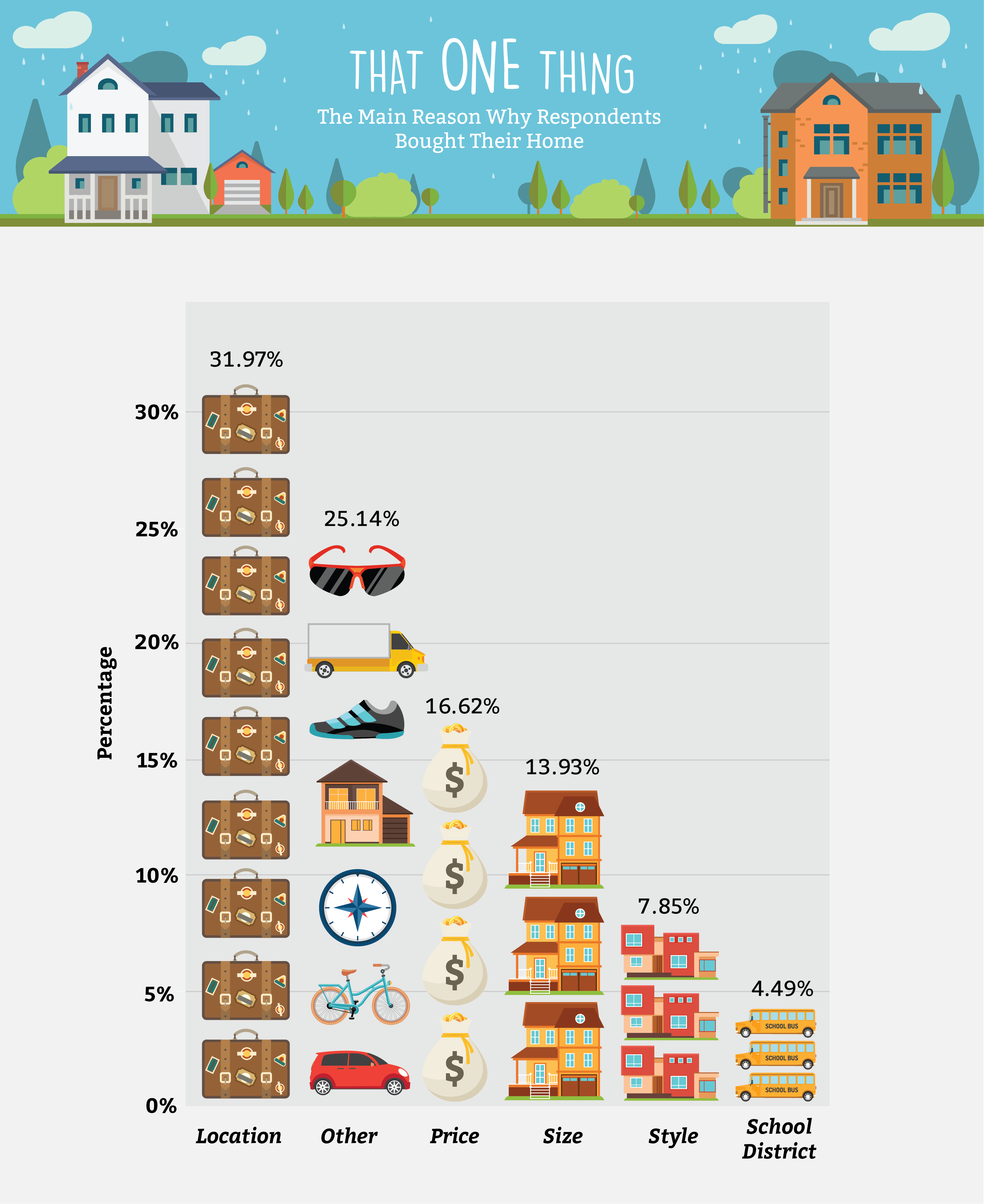

There are a lot of reasons to buy homes for sale, as we covered earlier. The most important goals, according to our respondents, actually have very little to do with the house itself.

As the graphic shows, individuals prioritize location when looking for a home to buy. And this makes sense — what good is a new home if there’s nothing around it to keep you there? Roughly half the amount of respondents identified monthly payment with the lowest interest rates as the most important reason.

Curiously, school districts pulled in at last place here. This could have something to do with the fact that many of today’s first-time homebuyers are millennials, who are pushing off having children for more extended periods than previous generations.

Over Budget

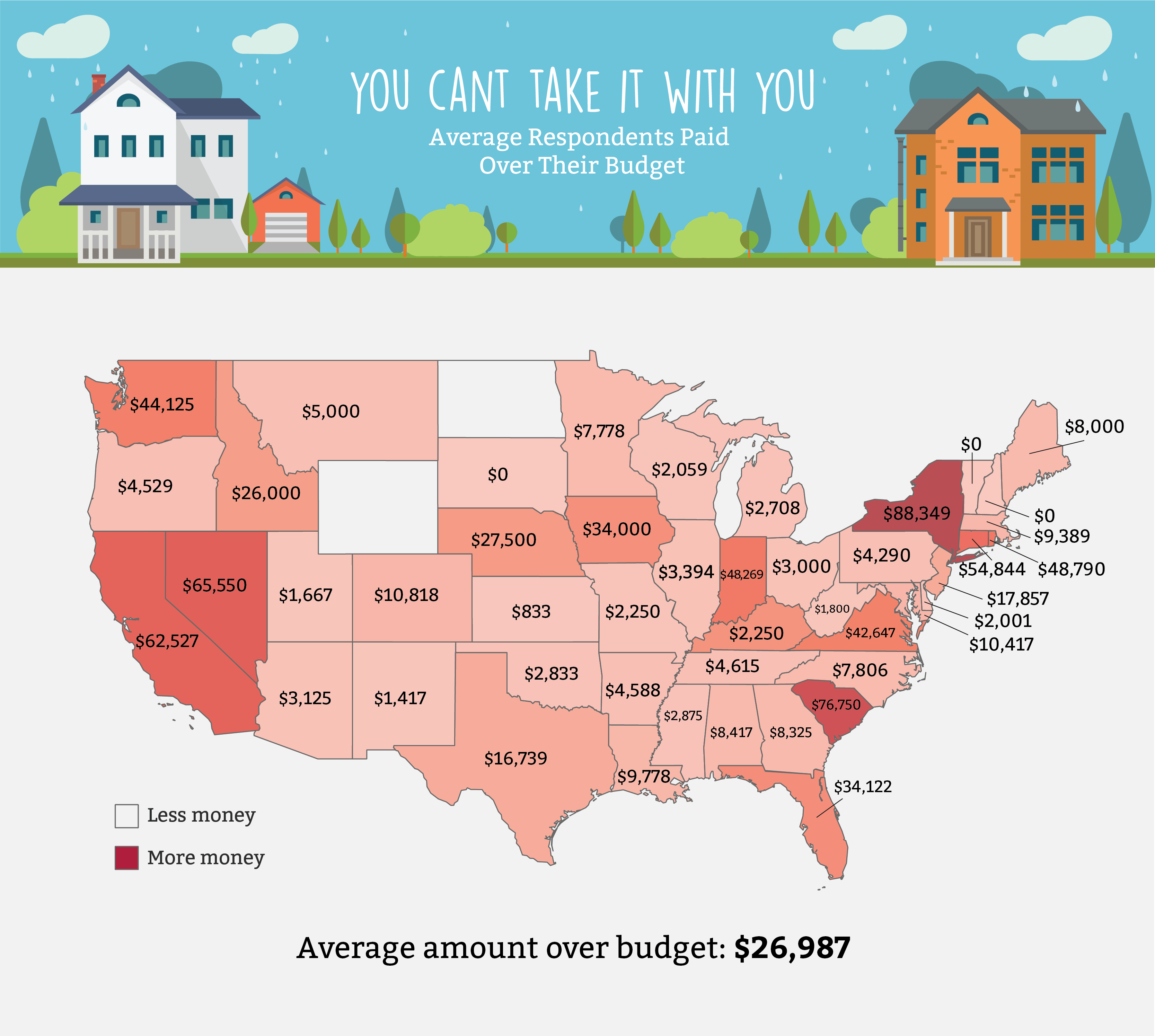

Going over budget for big-time purchases is more common than you think. However, the consequences for doing so depend much on surrounding factors, and those can change a lot depending on which state you’re moving to.

Our study shows that respondents in New York, California, Nevada, and South Carolina are having the hardest time sticking to their budgets. New York is particularly egregious, with respondents spending almost $90,000 more than the initial price range (not including closing costs). Then again, New Yorkers already live with some of the highest costs of living in America.

Taking Your Time

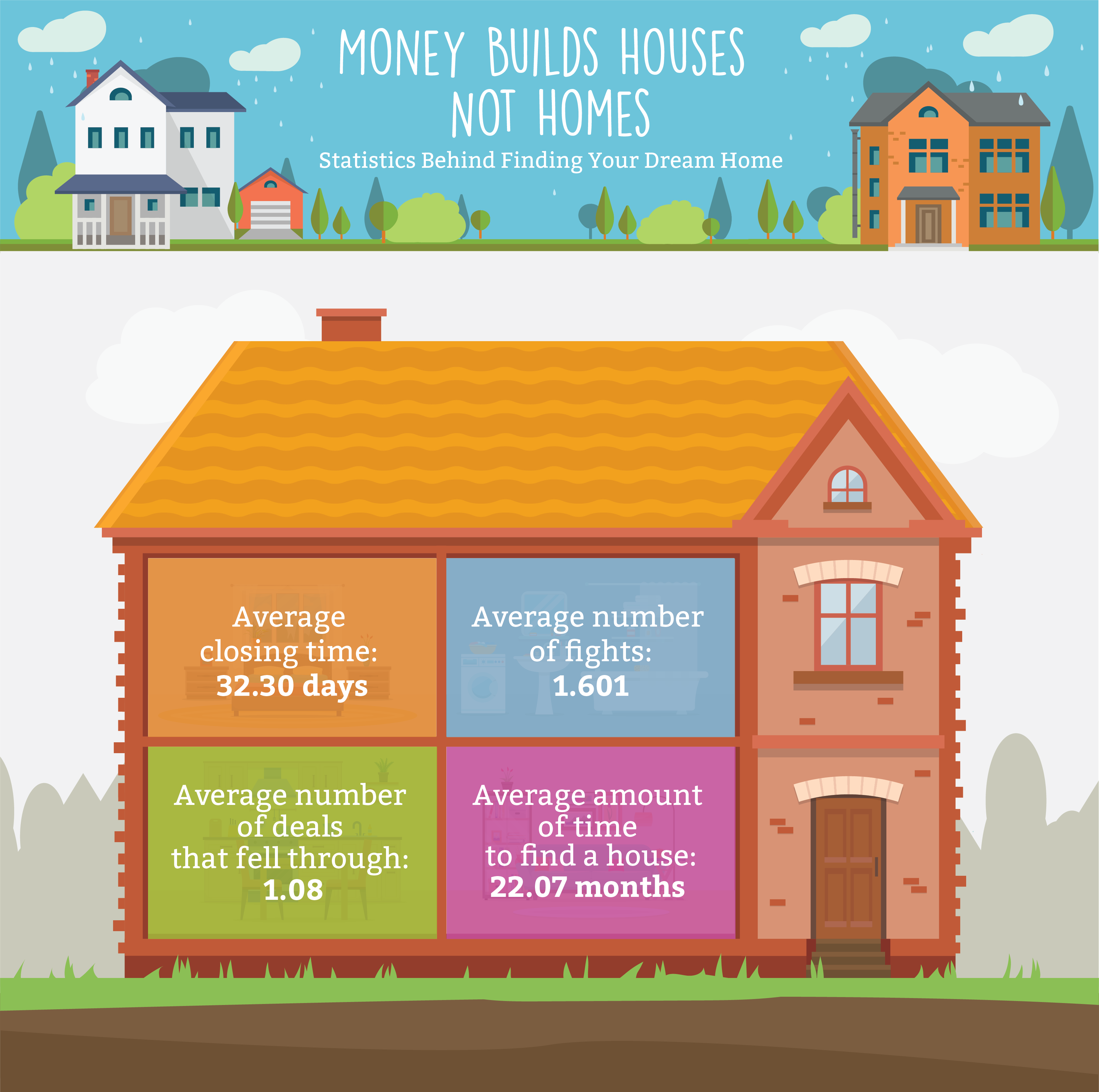

If you’re really in the market for your dream home, don’t expect to find the perfect fit too quickly. Our respondents don’t seem to be in too much of a rush, as they spend an average of 22 months just looking for a new house on average.

Even after that, our study shows that it usually takes just over a month to close on a deal.

Taking your time to find your new home is essential. After the home buying process, you’re going to spend a lot of time there. Homeownership tenure has increased substantially over the years, with families spending almost nine years in one house on average.

Don’t Forget Your Lawn

If you want to make a house feel like a home, you have to take care of the entire property — not just what’s inside of the house itself.

A neatly-kept lawn is one of the most apparent signs of a responsible homeowner. And, just like with finding the house in the first place, it’s best to take your time to ensure you’re tending to it the best you can. Our respondents spend at least four weeks on average, looking for a lawn care professional.

Considering that lawn care services can cost over $200 per visit, this isn’t a decision you should brush off.

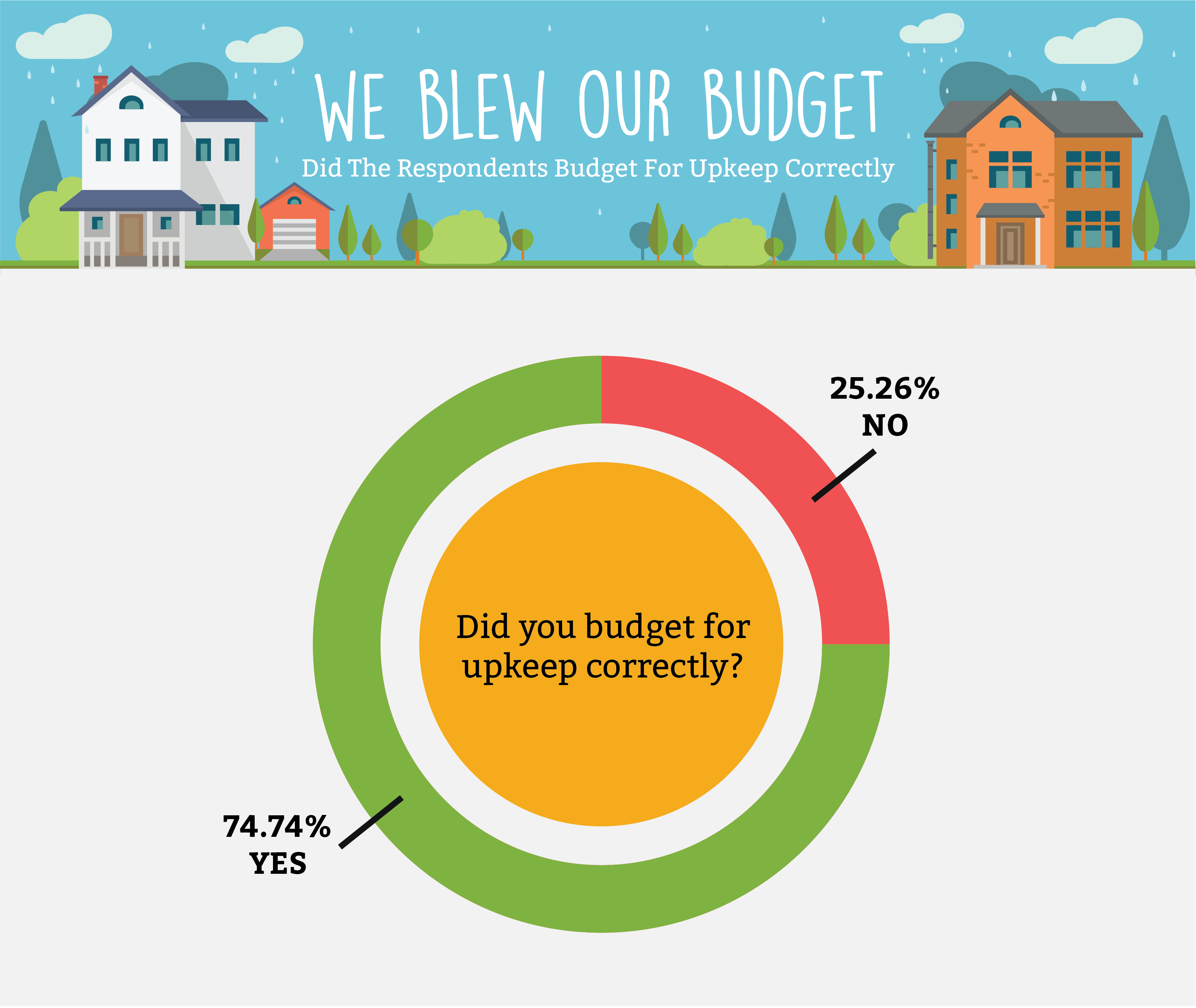

Did You Budget Correctly?

When it comes to homeownership, budgeting for that first initial purchase is only the first step. After that, it’s all about upkeep.

While the majority of our respondents reported setting aside enough funds for upkeep, almost a quarter did not. That’s a sizable chunk of home buyers that weren’t prepared for the extra costs. Nevertheless, homeownership rates have been on a steady increase in the United States between 2016 and now.

In Conclusion:

All in all, our study shows that homeownership remains an achievable goal for individuals who are willing to discipline themselves financially. The biggest lesson here is to prepare to be unprepared.

Things like keeping and maintaining a good lawn, which we covered, are more accessible than you think. Lawnstarer.com has all of the resources you need to get you started.

Methodology

All participants were screened using a two-pronged approach: (1) description of selection criteria with a requirement for self-acknowledgment and acceptance, and (2) directly asking each participant to confirm each criterion, namely “purchasing” a house. The term “purchasing” was defined as “acquire (something) by paying for it; buy.” A total of 1,257 attempts were made to take the online study, with 199 eliminated for: (1) not buying a home, (2) failing captcha, (3) not completing the survey, or (4) a mixture of these. Additionally, ten response sets were eliminated for having duplicate IP addresses, for a total of 209 eliminations, yielding a final completion rate of 83.37%, and a final n = 1,048. This study employed an online survey using a convenience sampling methodology via Amazon’s Mechanical Turk, with a subsequent posteriori exploratory, correlational data analysis methodology employed after completion of data scrubbing via Microsoft Excel and data visualization via Tableau.

Want to use our study?

Please feel free! All that we ask is that you include a link back to this page so readers can learn more about the study.